|

| |

Copyright © 2023, Michael D. Jenkins, Esq. and Ronin Software

All Rights Reserved

WALL STREET RAIDER v. 9.75 INFORMATION AND DOWNLOADS

An "...IMAGINATIVE, STIMULATING, EDUCATIONAL..."

Business Simulation -- Investor's Business Daily

|

WALL STREET RAIDER SIMULATION: PRODUCT INFORMATION

WHO PLAYS WALL STREET RAIDER?

Wall Street Raider (for Windows XP, Vista, Win 7/8/10/11) is played by (registered)

customers, ranging from 9-year-olds to hedge fund managers and corporate CEOs, in 114

countries and possessions at present (that we know of), ranging from Kazakhstan to

Vietnam to Qatar to Paraguay to Greenland to Namibia to Barbados to Albania to the

Falklands, to the Sultanate of Brunei and beyond -- and we recently had our first

two orders from Antarctica!

This Wall Street investment simulation is widely recognized as the ultimate

in sophisticated financial simulations. It's a corporate takeover and stock market

game, in which players strive to build their corporate empires by fair means or foul,

all the while trying to stay one step ahead of the SEC, IRS, Justice Department, EPA,

Congress, powerful unions, corrupt governments, and ruthless competitors who will

crush you if you fall into a weakened financial situation -- not to mention various

man-made and natural calamaties and economic disasters you will have to survive.

2023 UPDATE! Version 9.75 of Wall Street Raider is now available!

It includes (a sign of the times!) built-in inflation in prices of gold, silver, and

cryptocurrencies. It also has introduced Bitcoin and Ethereum cryptocurrencies as

new asset classes in which you can speculate, plus futures trading on both, for even

more extreme volatility and risk. Numerous other new features include the ability to

replace the management of a poorly run company with the better management of a company

it acquires; the ability to "repeal" the civil or criminal antitrust rules, or both,

if you wish to create a lawless, 19th-century style "robber baron" economic environment;

addition of Vietnamese companies; a new setting to turn off cash flow warnings if they

become too frequent when you control a large number of companies; and numerous other

improvements.

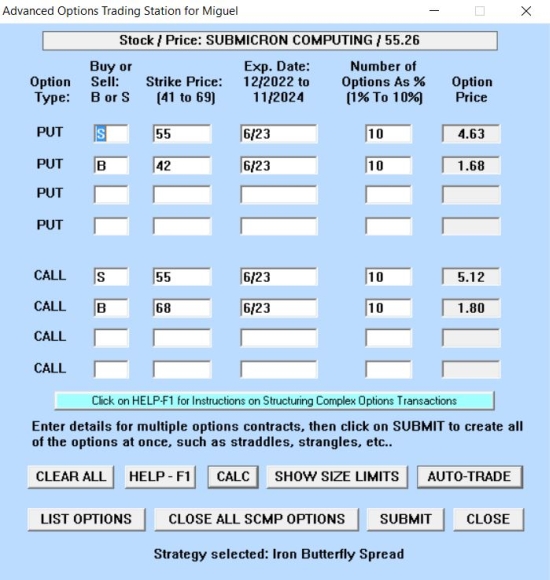

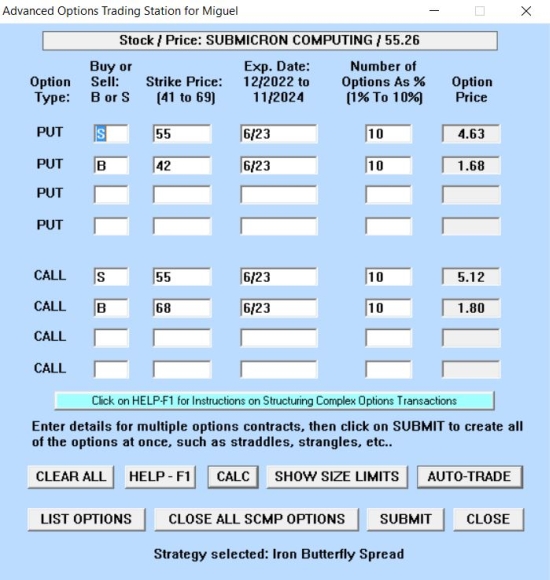

Changes in new Version 9.75, released in January, 2023 almost entirely came from

suggestions by users. One of the main improvements was a new Advanced Options Trading

Station, similar to what real-world online brokers offer customers. In Wall Street

Raider, the new Advanced Options Trading station enables you to construct elaborate,

esoteric options strategies, like those utilized by professional options traders,

letting you execute up to 8 trades at one time (4 call option trades and 4 put option

trades). It also provides an instant "HELP" file link that gives detailed explanations

and examples of all of the most popular options strategies, such as strangles, vertical

call spreads, calendar spreads, Butterfly spreads, and Iron Condors.

Since most such multiple option trading strategies are rather complex and may be hard

to grasp, the Trading Station even includes an "AUTO-TRADE" button that brings up this

menu, from which you can select any of the following complex strategies, and the

software will instantly post all the necessary data to the Trading Station screen for

you to examine (or perhaps modify) before you hit the "SUBMIT" button and execute all

of the trades:

Using these new options trading tools, as well as digesting the

accompanying HELP file tutorial on these sophisticated strategies, will definitely

give you a better understanding of how put and call options can be used in your

own, real world investing and trading, as well as in playing the Wall Street

Raider simulation.

Other new features include price alerts you can set, for the spot price of

gold, silver, crude oil, wheat, silver, or cryptocurrencies, plus rate alerts

for when an interest rate or the economic growth rate (GDP) reaches a level you

specify. See the Wall Street Raider UPDATES

page for more on the above changes and other new features in the Version 9.75

release.

Version 9.50, released in January, 2021, added detailed 3-month cash flow projections

for corporations and diagnostic warnings for companies you control that are expected to

incur a cash flow crunch (no more cash, no more line of credit) in the next 3 months.

Among other major improvements, Version 9.0 added 5 new Exchange-Traded Funds

(ETFs), two of which are triple-leveraged (3X) Stock Index funds, one for going "long"

on the Stock Index and one for shorting it. The other 3 new ETFs are bond funds: a

government bond fund, an investment-grade corporate bond fund, and a corporate "junk

bond" fund. The simulation now includes these 5 new ETFs plus the 15 "sector ETFs"

that were added to the program way back in 2012.

Other features added in v. 9.50 include a very rarely occurring but always

devastating "pandemic scenario" and an improvement in the database search module

that allows you to search for stocks in a single industry that meet your screening

criteria. Bank financing rules have been liberalized, to give companies larger

lines of credit -- in short, giving them a better chance to get into deep

financial trouble.

Recent versions 8.00 and later allow you to invest in convertible bonds or have

your companies issue convertible bonds, plus introducing other new features such

as being able to manage exchange-traded investment funds (ETFs) like hedge funds,

the ability to reset the default currency exchange rates, and a new stock price

alert feature which will alert you when a stock reaches a price you have specified.

Mainly, however, the focus in Versions 8.xx was on INCREASED REALISM, especially

with regard to trading derivatives (options, futures, and interest rate swaps).

Other features added in upgrade releases in recent years have included:

- Bitcoin and Ethereum cryptocurrencies, or futures trading on each, as wildly

fluctuating new speculations you can dabble in

- built-in inflation in "inflation hedges" such as gold, silver, Bitcoin, and Ethereum

- a new feature that lets you repeal (turn off) antitrust laws, making for a

more lawless economic environment, facilitating monopolies

- the ability to set asset allocation percentages for various

asset classes, for any bank you control, which the bank will strive

to maintain, except in extreme conditions when doing so would be

foolhardy

- showing, in the list of all your controlled companies, the capital

spending growth rate and R & D or marketing expense as a percentage of

sales for each, and whether or not the company is on "autopilot"

- the option to play against MULTIPLE (up to 4) computer players

- an automatic "sweep" function you can turn on or off, which will "sweep"

any cash in a player's bank account to reduce his/her loan balance

- one-year cash flow projections for players

- performance rankings of ETFs

- players or their companies can now list stocks or assets for possible sale to other

players or companies (or buy items offered by other players or companies that are "listed"

as being for sale)

- it is possible now to "look under the hood" at corporate data to see which companies have

positions in all of the various types of assets or contracts (such as interest rate swaps,

futures, options, subsidiary holdings, etc.)

- ability to put companies you control on "autopilot" (self-managed -- by

the program), when your corporate empire grows to include more companies

than you can effectively manage yourself, while the "autopiloted" companies

will ask your permission before doing certain major transactions like stock

purchases or issuances

- stock index futures trading

- investment management contracts for financial companies that manage ETF's

- 5-year charts for the stocks of each of the 1590 activated companies in

the simulation, and for commodities, interest rates, GDP growth rate, the

Stock Index, and the player's net worth

- interest rate swaps (derivatives -- "bets" on future interest rates)

that you negotiate have been added as another tool for hedging or speculation

- commodity futures trading was added on oil, metals and grains, plus hedging of

those commodities by companies that use or produce them; plus futures trading on

the Stock Index, in addition to buying and storing of physical commodities for

players and all companies except banks and insurers

- a player can be awarded executive stock options after becoming CEO of a company,

and CEO bonuses are now more closely correlated to company earnings performance; and

- short-selling of stocks and ETFs and highly realistic put and call options trading

on all publicly traded stocks and ETFs.

(Some of the above features are not enabled in the free version.)

For update information and a detailed description of new features in recent versions,

click here.

NEW STOCK TRADING GAME!

Traders and speculators, take note: In 2016, we introduced Speculator:

The Stock Trading Simulation, a "spin-off" from Wall Street Raider,

utilizing the W$R "engine" as the trading background, but where you are not a

billionaire who can influence or manipulate stock prices, but merely a small,

middle-class investor who starts out with a mere $100,000 inheritance to invest

or speculate with. ($21.95 or, for registered purchasers of W$R, $10.95.) For details,

CLICK HERE. A major new upgrade, Version 4.0,

was released on October 1, 2022.

NOTE TO MAC AND iPAD USERS:

Click here for

information about running Wall Street Raider on a Mac, iPad or iPhone.

WALL STREET RAIDER GAME GOALS AND FEATURES:

In this highly realistic simulation, 1 to 5 players (including up to 4 computer

players, if you choose) compete to amass fortunes by investing in, or taking over

and managing, any of up to 1590 companies in 70 industry groups. You start

off rich, with up to $1 billion, which is enough to take over one or more decent-sized

industrial companies, or to start up your own company in any of 70 industries, and the

idea is to get richer. MUCH RICHER! (And richer than any of the other human or computer

players you will be competing with.)

One of the unexpected by important side effects of playing this simulation,

besides the entertainment value, will be a seat-of-the-pants educational experience

about how markets, corporate finance, economics, and taxes work, and learning such

practical skills as understanding and deciphering balance sheets and earnings reports.

(Many long-term players of this game, some of whom began in their early teens, tell us

that they have parlayed what they learned into very lucrative careers in investment

management and corporate finance. See a few examples here).

Once you acquire control of a company, you and your company will use all

the tricks of the trade of real Wall Street corporate

raiders ("Wolves of Wall Street") to expand your empire and net worth, including:

- trading or investing in stocks and Exchange-Traded Funds (ETF's)

- having a brokerage firm or insurance company you control become an ETF adviser

and manager, earning a basic management fee based on assets, and perhaps earning

large performance bonuses for superior results, like a hedge fund manager (or

being fired as the fund's adviser, for under-performing the market averages!)

- trading or investing in corporate and government bonds

- investing in or financing your companies with "straight" or convertible bonds

- gaining voting control of other companies, in order to run them (and try to

manipulate their earnings and stock price)

- industry domination and monopolization, by increasing your company's (or companies')

market share in its industry

- increasing capital spending to take advantage of lucrative rates of return on

capital in your industry, as well as to increase or maintain market share; or decreasing

or eliminating such spending to increase cash flow, in order to diversify or pay down debt,

or when an industry becomes too competitive and return on invested capital becomes too low

- setting bank lending policies, for any banks you control, such as restricting lending

to competitors or ruthlessly calling in the loans of corporate competitors or other

players

- options trading, for speculation or to hedge stock positions

- short selling of stocks, options, and commodity or stock index futures

- speculating in or hedging with commodity futures and stock index futures

- trading in physical commodities (oil, gold, silver, wheat, corn) that you

buy and store, to wait for a better price

- speculating in ultra-high-risk interest rate swaps, by creating custom-made

derivatives contracts (that are bets on the future direction of various interest rates)

- speculating in Bitcoin and Ethereum cryptocurrencies, and futures trading on each

- having banks or insurance companies you control invest (speculate) in high-yield

junk bonds or risky "subprime" mortgage securities, or by buying up high-yielding but

risky corporate loans

- IPOs/startups, to raise capital or to create a new subsidiary to enter a highly profitable industry

- private placement stock offerings to raise "outside" private money or from within your corporate empire

- cash or stock tender offers for corporate takeovers, or cash tender offers for LBOs

- "greenmail" stock buybacks to get rid of hostile or unwanted minor shareholders in your companies

- stock-for-stock mergers to diversify or to gobble up competitors and increase industry dominance

- LBOs (leveraged buy-outs)

- "white knight" defenses to protect your control of a company by bringing in "neutral"

corporate shareholders

- buying up distressed debt (bonds) of companies in financial trouble

- launching antitrust lawsuits and other litigation to harass financially

vulnerable competitors, or sometimes win large judgments or settlements

- mass layoffs and restructuring of companies to increase efficiency and

profitability

- spin-offs or liquidations of subsidiaries, tax-free or otherwise

- excessive salaries and lavish executive stock options, provided by a company

you control, if you are elected as its CEO, plus possible large performance

bonuses for increasing earnings

- increasing dividends of companies you own (or cutting their dividends, to conserve cash)

- firing management, in the hope that new management will be an improvement

- asset downsizing

- recapitalizations

- tax avoidance strategies to avoid income taxes and various taxes on capital

- asset-stripping liquidations

- manipulating earnings by increasing/decreasing spending on R&D or marketing,

or by using "hidden" accounting reserves as "slush funds"

- earning management fees from Exchange-Traded Funds (ETF's), for securities

brokers or insurance companies you control

- using any and all methods to get the stock price up, in a company you control,

including sometimes engaging in "unethical" (and risky) actions, and

- delegating most management decisions in your corporate empire, Warren Buffett-style,

by turning on the an "auto-pilot" feature, once you have acquired control of too many

companies to effectively micro-manage them all, while still making the major decisions

for your companies on choices like which companies they will buy or sell or merge with,

or which industries to enter or exit

... and much more, all in the quest for the Almighty Dollar.

An individual player can engage in risky (but sometimes lucrative) activities

for his or her own account, such as short selling of stocks, and players or companies

can engage in buying and shorting put and call options and commodity futures on

crude oil, gold, silver, wheat, and corn, or can gamble with massive leverage

on interest rate swaps (derivatives contracts). Although the U.S. dollar is

the default, players also are able to instantly configure the simulation for

any one of 22 other currencies, before starting a new game, starting off

with the equivalent of up to $1 billion in Euros, Pounds, Yen, Canadian or

Aussie dollars, etc. Use the default currency exchange rate or, in Version 8.0

and later, set the exchange rate yourself at the start of a new game.

ETHICS? (ON WALL STREET?)

No Wall Street-based game

would be complete without ethical considerations being a major factor. So,

of course, you will have ample "ethical choices" thrust upon you from

time to time, where you will have to choose between playing ethically,

or (possibly) winding up in serious legal or financial trouble if you

decide to "Go for the gold," rather than "Do the right thing." Recent versions

even include a "Cheat Menu" that lets you obtain "insider information" on

upcoming mergers or major changes in a company's fortunes (good or bad),

which you can greatly profit from. Of course, there's always a chance your

informant may turn into a "stool pigeon" and thus you could be prosecuted and

perhaps convicted of illegal "insider trading.... with harsh consequences!"

TRADING ENVIRONMENT AND PLATFORM:

All your investment research and financial wheeling and dealing occur

against the backdrop of a constantly shifting economic and political

landscape in which you and all the companies and industries in Wall

Street Raider must operate and try to cope. The main screen is your

Trading Desk, on which you can always see a moving "live" stock ticker

tape, a scrolling financial news tape, flickering, constantly updating

stock prices on your "streaming quotes" list of up to 15 stocks, as well as

frequently changing spot prices for each of 5 commodities and the (tradeable)

Stock Index, plus the current GDP growth rate of the economy and various

interest rates (long- and short-term government bond yields and the Prime

Rate). One section of the Trading Desk also shows your (condensed) personal

financial balance sheet, so you can see at a glance your personal net worth

and available bank line of credit (if any) fluctuating second by second.

DECISION-MAKING:

Speedy decision-making is of the essence, and sweaty palms are a certainty,

as you try to cope with and anticipate changing market conditions and keep

your companies' earnings and stock prices on an upward track -- or at least

keep yourself out of the humiliation of bankruptcy and expulsion from the

game. You also have to deal with cash flow issues, such as by having your

companies raise capital by stock or bond issuances when the time is right,

and will need to try to keep powerful competitors from squeezing your

company's profitability or seizing control of your company -- unless

the price is right, of course!

COMPETITION:

Opposing players, including the Computer players, can be ruthless,

especially if you let yourself or your main companies get in a vulnerable

financial condition, where frivolous, harassing lawsuits or freezing your

line of credit or calling in your loans can put your companies (or you)

out of business or at least be financially crippled. In this simulation,

as on Wall Street, "It's all about survival, baby," and only the strongest

and smartest survive!

|

DOWNLOAD FREE TRIAL VERSION OR PLACE ORDER:

We believe in "try-before-you-buy," so to download a

free copy of the "shareware" (evaluation) version of Wall Street Raider (for

Windows XP/Vista/7/8/10), click here.

Or go to our Downloads page

to download a shareware copy of Wall Street Raider from any of

dozens of major shareware download sites.

To order the registered version of Wall

Street Raider, or the Windows Version "Add-on Package," select one

of the ordering links below, for the Windows versions or the

"antique" MS-DOS version:

SUGGESTION: WHEN ORDERING, YOU DO NOT NEED THE 2-YEAR EXTENDED DOWNLOAD SERVICE OFFERED

BY MYCOMMEREC/SHARE-IT (FOR AN EXTRA FEE). WE WILL REPLACE YOUR COPY OF WALL STREET RAIDER

(FREE, AT ANY TIME) IF YOU LOSE IT FOR ANY REASON (DISK CRASH, NEW COMPUTER, ETC.). JUST E-MAIL

mdjenk AT aol (DOT com) WITH YOUR NAME OR REGISTRATION NUMBER TO REQUEST A REPLACEMENT COPY.

To order, use one of the following links:

- $24.95 for the Windows

registered version of W$R, plus the "Customizer Utility" program. The "Customizer" allows you to

permanently change the company names or stock symbols for any of the stocks in the simulation.

- $29.95 for the Windows version,

"full package deal" -- Consisting of the Wall Street Raider game software,

which includes the "Customizer Utility" program and the extensive (electronic) strategy manual,

"Wall Street Raider -- The Book" (NOTE: THERE IS NO PRINT VERSION OF THE MANUAL.)

- $11.95 for the Add-on

Package Only, which includes the new (electronic, not printed) strategy manual, entitled

"Wall Street Raider -- The Book" (an electronic guidebook for playing W$R, in HTML format, plus

the Customizer Utility program, that works with the W$R software. (This add-on

package is for those users who already have a version of the W$R software (either the full registered

version or the free "sharware" version). YOU DO NOT NEED THE ADD-ON PACKAGE IF YOU PURCHASE THE "FULL

PACKAGE" ABOVE, WHICH INCLUDES EVERYTHING THAT IS IN THE ADD-ON PACKAGE.

- $250.00 for a

site license and downloadable copy of the "Full Package" version, which includes a site

license to distribute up to 200 copies of W$R to students or for other end users. Due to

the realism of the simulation, Universities from the University of Mexico in Mexico City

to George Brown University in Toronto have found Wall Street Raider to be a useful tool to

make students in their business and finance courses more conversant with real world corporate

finance. (For home schoolers or other small groups, email us at mdjenk AT aol (DOT com) for

possible reduced price, or in some cases a free site license.)

- or, for $21.95, try our spin-off from Wall Street Raider -- our stock trading game called "Speculator,"

in which you start each game as a middle-class investor with only $100,000 (not a billion), and can

invest in stocks, bonds, convertible bonds, options, and futures, but cannot take over and manage

companies. (Sorry, no way to run a company and manipulate its stock price in this challenging simulation!)

CLICK HERE

to order Speculator.

REGISTRATION BENEFITS INCLUDE REDUCED PRICE FOR ANY FUTURE UPGRADES

(for the "Full Package" that will include the latest version of the

(electronic) W$R strategy manual and the "Customizer Utility" program).

When you order a Windows version of Wall Street Raider, your purchase also includes

the right to order future updates/upgrades at a greatly reduced price, $14.95,

instead of the regular price of $29.95.

UPDATES/UPGRADES AND SUPPORT:

See the updates page to see what improvements have

been added since the version you currently have, so you can decide if or when to

purchase upgrades/updates. To contact Ronin Software for CUSTOMER SUPPORT,

click here

|

NOTE: When purchasing through MyCommerce/Share-It's secure server

online e-commerce site, you will not instantly download the program, but

will automatically be sent an e-mail by Share-It, which will notify you that

your order has been accepted and give you the URL where you can download

the registered version of the program during a specified number of days.

If you do not receive your registration/download information, please contact

MyCommerce Shopper Support.

Ronin Software does not process the credit cards. (And be sure to check

your "SPAM" in-box, if you do not immediately receive an e-mail link from

MyCommerce/Share-It when you order -- that's where the "missing" e-mail will

be, 99% of the time.)

|

|

REVIEWS AND USER COMMENTS:

Take a look at our comments page, to see what

users say about Wall Street Raider.

Or, view a series of YouTube

STRATEGY VIDEOS one game reviewer created, showing

you what playing a game of Wall Street Raider is like, plus his commentary. These

are the first of a series of videos this chap (an obvious W$R junkie and expert)

is creating, all of which are accessible on YouTube. The videos will give you an

idea of some of the things you can do in Wall Street Raider (based on Version

7.60 and, in a new series, on Versions 7.8x, with 8.0 to come) and strategies for

generating trillions (or more) in profits, trading stocks, options, futures and

dealing in interest rate swaps. He has also begun posting a series of

TUTORIAL VIDEOS on

YouTube,

including a NEW (2021) TUTORIAL on

VERSION 9.0 of Wall Street Raider.

Wall Street Raider has been published and under continuous development

since 1986, and it has received a number of very favorable reviews

over the years from major Web sites, such as ZDNET, Download.com and PCWorld,

as well as highly favorable reviews in print publications, including the Wall

Street Journal, Byte Magazine, PC World, and, on June 22, 2000, we rated a

two-column, very favorable front-page article in Investor's Business Daily,

which called W$R an "...imaginative, stimulating..." business simulation.

(That was a review of the old DOS version -- we came out with the much more

sophisticated Windows version a year later.)

Previously, respected computer columnist Jerry Pournelle had written of W$R,

that "You can really learn something about stocks, mergers, takeovers

and the general world of finance, and have a whacking good time in

the bargain."

Or read this detailed review of W$R on the

Daily Speculations web

site of legendary hedge fund manager Victor Niederhoffer,

with the review written by Sushil Kedia, a frequent guest on CNBC in India. (In one

of his books, George Soros wrote that Niederhoffer was

the only one of his managers who ever retired voluntarily from trading for him while

still ahead.) Niederhoffer's hedge fund was ranked #1 in the world, earning 35% a year

from inception to 1996 but, alas, he was nearly wiped out in 1997 by excessive

speculations in Thailand. Since then, he says he has been "...crawling back up the stairs,

not entirely without success," after mortgaging his house and selling off his collection

of antiques in 1998. As in Wall Street Raider, the real financial world is a jungle, in

which one can go from riches to rags in a heartbeat....

SAMPLE SCREEN SHOTS

Click here to see a sample screen shot of Wall Street Raider (Windows version).

Or here, to view a sample Entity Research Menu and industry outlook commentary.

Or here, to view a sample General Research Menu and economy & markets commentary.

Click here for a sampling of News Headlines generated by events in a typical game.

W$R FORUM! Wall Street Raider now also has a "blog" fan site (not sponsored

by us) -- see the link here....

Check it out, if you want to brag to or otherwise communicate with other Wall

Street Raider addicts...!

To download a free copy of the shareware (evaluation)

version of Wall Street Raider go to our Downloads page

to download from any of many shareware sites that host the program.

Ronin Software is a

Software Industry Professionals Member.

|

NOTE FROM THE PUBLISHER TO MAC AND iOS USERS:

RUNNING W$R, A WINDOWS PROGRAM, ON A MAC OR iPAD: Wall Street Raider is a Windows

program. However, there are now a number of applications players have used to run Windows programs

on their Macs, such as the combination of Wine/WineBottler (which is free), or commercial programs

like Parallels Desktop or Crossover. Because newer Macs use Intel processors, they can run Windows

and Windows applications as quickly as PCs. Most such apps require you to (buy and) install

Windows on your Mac, although Wine/Winebottler and the commercial program CrossOver do not. We do

not recommend any specific Windows virtualization or dual boot programs, but we have heard from

users of Crossover that it works flawlessly with Wall Street Raider, though you may not want to

buy it, just to run W$R. Parallels Desktop also (allegedly) works perfectly with W$R, which is

not surprising, since you need to buy a Windows license and install Windows to use Parallels.

Some users of WineBottler have reported that they were unable to run W$R or Speculator under

it on their Macs (for reasons unknown).

Also, there is now a subscription service call Parallels Access that offers an

iPad app that will allow you to run Windows programs on an iPad, or even run Microsoft

Office programs on an iPad.

Although Wall Street Raider does not run natively on a Mac, you may use the

following software product to run the game on a Mac:

VirtualBox for Mac.

You may download VirtualBox for free from its official web site at: https://www.virtualbox.org/wiki/Downloads.

On the web site, select “OS X hosts” to download and run the installer. After the installation, you can find an Oracle

VM VirtualBox icon in the “Applications” folder in the Finder. For more detailed installation instructions, you may

watch this video tutorial prepared by the staff of De La Salle University: https://youtu.be/Qn4Jm-qMNcE.

We cannot guarantee that Wall Street Raider will be stable on these

virtualizers, so we STRONGLY suggest that, before you buy a registered copy of Wall

Street Raider to run on your Mac or iPad, you download and play the shareware (free)

version of W$R for a while with the Windows virtualizer app you have installed, if

you have one. If the shareware version works OK on your Mac or iPad, the registered

version of W$R should also, since the shareware version simply limits access to some

of the game's internal logic features and the length of games, and is a somewhat

smaller file, since many of the features of the registered version (like options

trading) are simply not compiled in the shareware version. You may also want to do

a Google search for "Run Windows programs on a Mac," to see what else may be

available, currently.

IPAD APP: Many fans of W$R have asked if there is an iPad or iOS

"app" being developed. There was, but there is NOT at present. In 2011, I licensed my W$R

source code to a company that tried to develop a simplified iPad version of W$R, but they

eventually ran out of development money after two years, before they could get it to work

properly, as W$R is an extremely complex program, in terms of the logic involved, which

requires an understanding of finance, economics, accounting, and taxes, etc., to understand

how it SHOULD work. Programmers who also have professional backgrounds as tax lawyer, CPA,

successful investor and options trader, million-selling author, and consulting economist

are not easy to find. I have all that background, which enabled me to develop W$R, using

the PowerBASIC compiler, an easy way to write Windows programs, and have created a

pretty nifty little program after plugging away at it and tweaking it for over 30 years.

However, I am not a software engineer, and I lack the tech skills to convert W$R to a

Mac or iPad app or do other complex things like creating an online multiplayer version.

Development of an iPad version resumed in May, 2014, and if it had succeeded this time,

an app was to have been available some time late that year. However, the developers

ran out of funding again, and still could not get 2+2 to (consistently) equal 4 in their

iPad version, so the latest effort was also abandoned. We are still open to partnering

with a larger, well-funded software company that might be interested in developing an iPad

or iPhone version, but are not optimistic. We have no desire to spends hundreds more hours

of consulting time with a software developer that is unable to create an iOS version that

actually works. (Or at least, not without a sizable up-front advance royalty payment!)

As a self-taught programmer with (very) limited tech skills, I feel I have just

about reached the limits of what I can do to develop Wall Street Raider, so at

this point my main goal is to do a licensing agreement with a large software firm

that has the ability to take W$R to the next level, if possible and feasible.

The quest continues....

|

|