|

| |

....WALL STREET RAIDER UPDATE DETAILS....

(Click on your browser's "refresh" button if you have visited this page before)

UPDATE NOTICE:

VERSION 9.75 IS NOW AVAILABLE, now featuring a number of new features, such as the addition

of alerts you can request, notifying you when a commodity price, cryptocurrency price, stock

index price, an interest rate, or the GDP growth rate reaches a level you specify. Other

changes include provision of a pick list of all the companies in an industry, when you want

your company to buy business assets from another company in its industry; or when your company

is selling business assets, a pick list is now displayed showing all companies you control

(including holding/trading companies) that are potential buyers of the assets. (You cannot

select a company you don't control and force it to buy assets from your company -- any sales

to uncontrolled companies are still made to a buyer -- if any -- that will be selected by the

software.)

Another useful change is the ability to set the maturity year when issuing bonds, as

short as three years and (subject to certain limits) up to 10 years for convertibles or

20 years for "straight" bonds. The interest rate your company will have to pay will be

somewhat lower on shorter-term bonds than on those with a more distant maturity.

Below are details on upgrades, updates, bug fixes, and other

improvements in the Windows version of Wall Street Raider. Click

here to see an image of the

main screen of Wall Street Raider (for Versions 6.0 THROUGH 9.75).

REGISTERED USERS: If you are a registered purchaser

of the Windows version, you can order updates/upgrades of the

new version (v. 9.75) at a greatly reduced price of $14.95, which

includes the latest version of the (electronic) strategy manual,

which now comes in HTML format, for hypertext viewing with your

default browser.

To access the reduced price ordering link, simply load your current

(REGISTERED) version of W$R, and click on the "Game Options/Updates"

menu item, which will take you to the ordering page on the Internet.

(If you have a very old copy of W$R, that only takes you back to this

page, e-mail us at mdjenk@aol.com

with your registration info and we will give you the link for ordering

at the reduced $14.95 price.) The file you will download will be

the "Full Package" version, 9.75.

SHAREWARE USERS: Download the latest W$R shareware

(free) version here or

here.

Note that the shareware version, limits games to 2 years in length and

options trading is not enabled; stock charts are also not generally available.

(The registered version allows games of up to 35 years length, and if that isn't

long enough for you, email us with your registration number and we will send

you a link to an "experimental" version that theoretically allows games to

go on for 999 years, though the compounding numbers will grow so large that

they will probably crash the program after about 100 years.)

To order the basic registered version 9.75 ($24.95), which also

includes the "Customizer" utility program that lets you permanently

change company names and stock symbols, or to order the "Full Package"

that includes the W$R Strategy Manual (electronic, HTML file, viewed

with your browser, not a print version) and the Customizer, for

$29.95, CLICK HERE

to go to our ordering page menu.

Check below, to determine if an update has been issued since

the version you currently have. As you can see, Wall Street Raider

is a "work in progress," and has constantly been improved and made

more realistic and usable over the years. The quest for perfection

continues....

OUR STOCK TRADING GAME!

Speculator: The Stock Market Simulation, Version 4.0, is

a "spin-off" from Wall Street Raider, a simulation in which you are not a

billionaire tycoon who can influence or manipulate stock prices, but just

a small, middle-class investor with a $100,000 inheritance to invest or

speculate with. As such, we think you will find it more challenging than Wall

Street Raider, as you have to be a nimble trader in stocks, bonds (including

convertibles), options and futures. For details, or to try a free (shareware)

version, CLICK HERE.

WINDOWS VERSION RELEASES THROUGH

January 1, 2023 (v. 9.75)

(Descriptions of releases are shown below in reverse order)

We don't expect anyone will read more than the most recent items

listed below, but this "abbreviated" page will give you some

idea of the tremendous number of improvements and extensions

we have made to the Windows version since it was first released

in 2001.

- 9.75 -- Released January 1, 2023

Many of the popular features in Wall Street Raider have been

developed in response to suggestions by users over the years.

These include some ideas (like adding Bitcoin) we initially

thought were "off the wall," or others, like creating and

realistically simulating price action for convertible bonds,

we at first rejected as being impossibly difficult to implement,

but eventually got around to including, after much trial and

error (and hair-pulling) in development.

Since we seem to be running out of good ideas ourselves lately,

almost all the upgrade features in this release are entirely in

response to a "to do list" of good ideas for "do-able" features

or changes that we have received since we released 9.50, coming

from several different users, and which we felt were worthwhile

improvements. We always appreciate the good input, though we

can't incorporate every idea someone comes up with, as we try

to keep the complexity and ease of use for simply playing the

game from becoming overwhelming for new players. The changes in

this release and prior releases are listed below as follows:

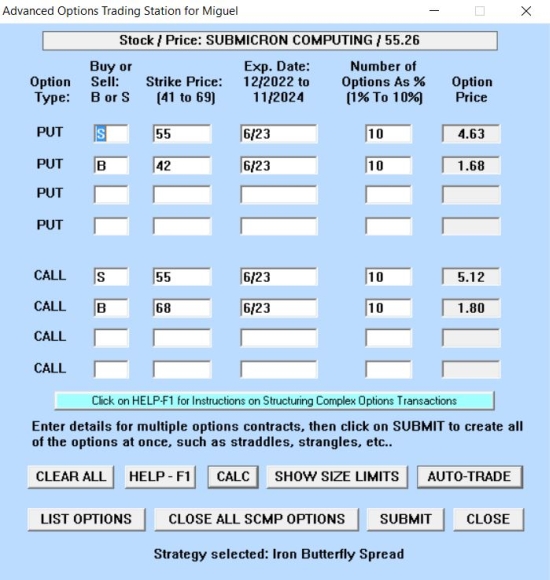

- Advanced Options Trading Platform Added.

We recently received an excellent suggestion by a user of Wall

Street Raider, requesting that we create an options trading

platform for doing complex options trades all at once, something

similar to the real-world Trade Station offering by Ameritrade.

Until now, it was possible to construct sophisticated options

trading strategies (hedges) in Wall Street Raider, such as

straddles, strangles, bull spreads, calendar spreads, Butterfly

spreads, etc., but you had to put the different options positions

in place one trade at a time. Very often, between putting in

the trades, the price of the underlying stock would have moved

significantly, making it difficult to implement the complex

position as you intended. Now, you can enter up to 8 trades on

the trading platform screen and execute them all at the same

time with a single click.

Also, one click on a "Close All XYZ Options" button will now

allow you to instantly close all option positions you have (or

a company you control has) on a particular stock, for instance,

on XYZ Corp. This is a handy additional feature of the trading

station platform. Thus, if you have established a complex option

strategy on XYZ Corp., such as an Iron Butterfly spread, and

you decide it is time to close out all of the positions in that

spread, one click on the "Close All XYZ Options" button will

instantly settle all of XYZ options at the current market prices.

To make such complex option strategies simple to implement, we

have added a new screen, an "Advanced Options Trading Station"

to this release of Wall Street Raider. It lets you do up to 4

put trades and 4 call trades, all at one time. This works out

perfectly, since many of the most common esoteric options

strategies involve either 4 puts or 4 calls, or 2 of each.

In addition, the HELP button on this "trading station" screen

will take you directly to a detailed discussion, with examples,

of all the major options trading strategies -- covered calls,

long or short straddles or strangles, vertical bull or bear

spreads, calendar spreads, Butterfly (and reverse Butterfly),

Condor and reverse Condor spreads, and Iron Butterfly or

Iron Condor spreads. You can learn a lot, by trial and error,

about complex options trading strategies with this new tool

and the accompanying instructions.

We have even "automated" the creation of the most widely used

complex options trading strategies, where you click on the

AUTO-TRADE button on the Advanced Options Trading Station to

bring up this menu:

You can simply choose one of the listed strategies and enter an

expiration month for all of the options that will be created,

plus enter the quantity of options for each of the contracts,

then click on the "GO" button to post the details of all the

components for the selected strategy on the Advanced Options

Trading Station screen. The Advanced Options Trading Station

image below shows an Iron Butterfly strategy created with the

AUTO-TRADE feature:

Once posted, you can either click on "SUBMIT" to execute all

the trades at once, or if you like, make any desired

modifications before execution.

- Commodity Price and Other Alerts Are Now Available.

In Version 8.0, we added stock price alerts to Wall Street

Raider. In response to requests of users who found the stock

price alerts very useful, aiding them in trading and investing

in stocks, this release has added price alerts on spot prices

of each of the five commodities in the simulation -- crude oil,

gold, silver, wheat, and corn, as well as on the Bitcoin and

Ethereum cryptocurrencies, and the Stock Index.

In addition, you can now set up alerts to notify you when any of

the interest rates (prime rate, long bond rate and short bond

rate) reach a level you specify, or when the GDP growth rate

goes above or below a growth rate you specify.

Because of the many, constantly changing economic and financial

factors in the game, as game time passes, it is often easy for

you to fail to notice some major change that is occurring, such

as a large increase or decrease in interest rates, or an

emerging economic boom or recession or spike in a commodity

price. Accordingly, you can now set up alerts for any of the key

economic and financial indicators, so you will be alerted when

one falls to or rises above levels you specify, which can be

very helpful in reminding you to review and perhaps change your

current investment strategy.

Up to 100 stock and/or commodity price or rate alerts can be

pending at any one time. As with stock price alerts, each

commodity price or other alert will remain in effect for a

full year of game play, or until the price or rate objective

has been reached and you have been notified by an announcement,

whichever occurs first. You can set up alerts at multiple

price points or rate levels on a particular item and on one

or more stocks.

Now, instead of a "Set Stock Alert" button on the MISC Menu,

that button has been replaced by a "Set Price or Rate Alert"

button, which brings up an extensive menu from which you can

pick the type of alert you want, either a stock price alert on

the current "Active Entity" or an alert on one of the various

commodities or other items for which alerts are now available.

- Buying or Selling Business Assets Streamlined.

In this release, when you wish to have your controlled company

buy some business assets from another company in its industry,

a pick list of all the potential sellers in its industry is

displayed. Similarly, if you want your company to sell some of

its business assets to another company you control, a pick list

of all the companies you control in the same industry, plus all

holding/trading companies you control, is listed for you to

select as the buyer. If you wish to sell the assets to a

company you do not control, then, as in previous versions, the

software will pick the potential buyer (if any) and indicate

how much it is willing to buy. (You cannot choose a company you

do not control and force it to become the buyer.)

- Setting Term of Bond Issuances. When you

decide to have a company that you control or an ETF that one

of your companie manages issue bonds, you are now able to set

the year of maturity within certain upper limits or for a term

as short as 3 years. The shorter the term, if less than 10

years, the lower the interest rate the company will have to

pay on the bonds, all other things being equal.

- New Database Search Features, To Find Companies with

Positive Cash Flow. Two new cash flow-related items have

been added on the Database Search screen. One allows you to

search for companies with projected positive cash flow for

the next 3 months. The other allows you to also include in

your search results those companies that have negative cash

flow overall, but that have positive cash flow before debt

repayments on their line of credit and/or the payoff of a

maturing bond issue.

- More New Database Search Features, To Find Short Sale

Candidates. Two more database search features have been added,

in order to search for possible short sale candidates. Select

the "FIND SHORT SALE CANDIDATES" item on the Database Search

screen and the program will look for stocks that have a number

of negative characteristics, such as downward momentum, excessive

price-to-net worth ratios, and negative cash flow, and will list

such stocks.

Since many of the stocks that will be listed will be those that

are D-rated (bankrupt, but not yet liquidated or reorganized),

and since the simulation will not allow you to short the shares

of such stocks, a second button, "...BUT EXCLUDE BANKRUPTS,"

has also been added, which will exclude any such "walking dead"

companies in the selection process, if you also check that box.

Thus, if you check that box to exclude the "zombie" companies,

the only short sale candidates that will be listed will be those

companies with "C" or better credit ratings, which you CAN sell

short.

- No More Automatic Dividend Increases by Companies

You Control. While previous editions of Wall Street

Raider did not generally do automatic dividend increases for

a company you controlled, that was changed when we introduced

the "autopilot" feature a few years ago, so that companies you

control that are on "autopilot" function pretty much like the

companies you don't control, except they don't do major actions

like buying a stock or initiating a merger, or issuing new

stock. However, some players found it annoying that when they

wanted a company on autopilot to stop paying dividends, or only

pay a minimal dividend, it would often boost the dividend if

the company had big earnings increases or had a great deal of

liquidity. Thus, in this release, companies you control will

not raise their dividend automatically, whether they are on

autopilot or not. (But will still cut their dividend payout

when necessary to do so, or in a "cash flow crunch.")

- Bank's "Hot Deposits" Now Shown on Its Financial

Profile. As a convenience to users who control or

invest in banks, we have added a line item in the Financial

Profile for a bank, showing the amount of its demand deposits

that are held by players or companies in the simulation, as

distinct from deposits by "the Public," which tend to grow or

shrink gradually. Previously, that information was only shown

in a Research Report on a bank.

Demand deposits by players or corporations in a bank should be

considered "hot deposits," since they can suddenly be withdrawn

at any time, such as when a company makes a large expenditure,

like a purchase of a stock or other assets. From the bank's

standpoint, it is nice to have a lot of such non-interest

bearing deposits, since the cash can be loaned out or invested

bonds or stocks. However, having a large amount of such "hot

deposits" can cause some instability, because of the possibility

of sudden and large fluctuations in those deposits, which might

cause liquidity problems for the bank, forcing it to sell assets

to pay off the depositor, possibly at an inopportune time.

- Advanced Options Strategies Added to the Strategy

Manual and HELP Files. For purchasers of the W$R

"Full Package" and for registered users who purchase this

upgrade, the W$R Strategy Manual now has a lengthy

section on complex options trading strategies used by real-

world professional options traders. Similar explanations

are included in the W$R HELP file. Those discussions cover

straddles (long and short), long and short strangles, bull

and bear call spreads, bull and bear put spreads, calendar

spreads, and even more arcane and complex spreads, such as

the Butterfly, Condor, Iron Butterfly, and Iron Condor.

Understanding the mechanics of the complex options

strategies may cause short-circuits in your brain as you

try to grasp how they work, but we decided to provide this

esoteric information for the benefit of players who wish to

delve more deeply into the intricacies of options trading.

(These complicated options strategies are actually easier to

utilize in our other game, Speculator, since W$R has some

"insider" restrictions on the use of puts and short calls

on stocks of companies you control, which may prevent you

from being able to create some of the more advanced options

trading positions we describe.)

- Currency Exchange Rates Updated. In the current

global economic crisis, exchange rates have been changing

rapidly, as the U.S. dollar strengthens against nearly all

other currencies. We have updated the exchange rates for the

22 non-US currencies for which Wall Street Raider can be

configured, as of late December, 2022.

- Saved File Compatibility. Version 9.75

is file-compatible with saved games from Versions 6.0 or

higher.

- 9.50 -- Released January 1, 2022 (Major upgrade)

- It's a sign of the times....Inflation has come to Wall Street

Raider! (No, not to the price of the game, which hasn't changed

since mid-2014.) In the simulation, inflation is not all bad;

this release adds an inflation factor to the price of gold and

silver, which will tend to gradually appreciate, all other

things being equal, at about 4% a year above an assumed initial

price of $1,200 per Troy ounce. (Indexing stops after 35 years

of play, which is the "standard" game length.) Thus, buying and

holding physical gold, or buying long-term (5-year) futures

will tend to be more profitable for gold and silver investors,

since their prices will now have an inflationary bias. This

will tend to make precious metals somewhat of an inflation

hedge, though not a great investment,

unless your timing is very good.

- As requested by a number of players, Bitcoin has been added as

a new asset class to trade in Wall Street Raider, and we have

also added Ethereum, another popular crypto-currency. As in

the real world, we have made the price action in both cryptos

EXTREMELY volatile, as pure speculations, and both also include

an inflationary bias, as with the precious metals. Thus, both

of the cryptos are also somewhat of an inflation hedge, if you

are not wiped out by the extreme price fluctuations in the

interim!

- We have also added a new (but rare) scenario, where Bitcoin

may be banned by most of the world's major nations. While it

will not be completely eliminated if that occurs, as it will

still be legal in a few countries like Belarus or Bangladesh,

its price will take an enormous plunge of 90% or more and won't

ever significantly recover from the banning during the rest

of the game. This danger adds another element of risk to your

trading in Bitcoin, which is already wildly volatile, both in

this simulation and the real world, where China has already

decided to ban the use of Bitcoin.

- Some players have been critical of the antitrust rules in

Wall Street Raider (corporate antitrust damage suits and

government fines, forced divestitures, and restrictions on

anti-competitive takeovers), saying that these rules, as in

the real world, make it difficult for the criminally-minded

create a good monopoly in an industry. Accordingly, as was

suggested, we have added a new "Cheat Menu" item that now

lets you turn off either the private antitrust suits or the

government fines and interventions, or turn off both. We

trust that making the simulation lawless will evoke memories

of the "robber baron" days of the late 1800s, when there

were few, if any, laws against monopolies. The only downside

of this new cheat is that it will disqualify all the players

from setting a "personal best" high score in that game.

- A "Suppress Cash Flow Warnings" item has been added to the

Settings Menu, to suppress such warnings, if you control a lot

of coompanies and are seeing too many such warnings.

- Several minor improvements in this release include the following:

- As one user suggested, we have added a new feature, when

you do a merger of a company with a company you did not

control prior to the merger. If the acquired company has

significantly better management than the acquirer, you may

sometimes be asked if you want to replace the management

of the acquiring company with the management team of the

acquired company. This will only occur under certain rare

conditions, when both are in the same industry and their

businesses are roughly comparable in size. (This feature

is not applicable if either company is a holding/trading

company, but applies to mergers in any other industry. It

is also not applicable if the player controlled both

companies before the merger was consummated.)

- We have changed corporate cash flow projections to show,

as a subtotal, net cash flow before debt repayments,

before arriving at the total net cash flow. This is a

more useful way of displaying the numbers, since in

many cases some or all of the amount to be repaid can

be borrowed right back, depending on a company's credit

rating at the time repayment is made.

- Vietnam has been added as another nation in which to

incorporate a start-up. As with a number of Third World

and Asian countries, incorporation of your startup company

in Vietnam will make it more difficult for a hostile

acquiring company to effect a merger with your company

in Wall Street Raider when there is a large percentage of

"public" stockholders who are more likely to vote against

the merger in such countries. Thus, incorporating in those

countries can be somewhat of a defensive strategy, to avoid

losing control of your company in hostile merger attempts,

in some cases.

As suggested by the player who urged us to add Vietnam

as another country in which to incorporate, we have made

projected earnings estimates for Vietnamese companies

much more volatile and often wildly inaccurate, which he

indicated is the case for Vietnamese companies in the

real world.

- Vietnam Airlines (a dormant company initially) has been

added, replacing Sabena Airways in registered versions

of W$R, since the real Sabena, a Belgian airline, is now

defunct.

- The Financial Profile of a company shows the amount of

any interest rate swaps to which the company is a party.

In this release, if the company is a party to only one

such agreement, which is the usual case, the name of the

counterparty is also shown in the same footnote, for

your convenience.

- In previous versions, when you wished to do an interest

rate swap (if a counterparty could be found), the sim

searched only for companies with a solid credit rating

and no existing swap agreements. In this version, the

search for a counterparty will include companies that

have only one interest rate swap in effect, if the

second one will be an opposite position. For example,

if Company XYZ already has a short position in an

interest rate swap, it could become a counterparty in

a swap where it becomes the long party; and vice versa.

- The Database Search function has been modified so that

any time credit rating is one of your search criteria

for stocks, the companies listed will be sorted by

credit rating, rather than alphabetically. A similar

change was made when doing bond searches in Version 9.0.

- In previous versions, a contingency reserve would often

be set aside to cover the after-tax costs of antitrust

litigation, for a company that was a defendant in one or

more pending antitrust lawsuits, but the amount set aside

was based on a simple, one-size-fits all computation. In

this version, a much more complex algorithm computes the

amount needed in the reserve, analyzing each such lawsuit

separately, and taking into account the level of risk

posed, as a better approximation of what amount should be

set aside. Then, if there is still a significant sum left

in the reserve after all such pending cases against the

company have been resolved, a portion of the reserve will

be added back to income each quarter, reducing the reserve,

in the case of companies not controlled by human players.

- We have fixed one tax loophole, to be congruent with Sec.

362 of the U.S. tax code. Previously, if ABC transferred

stock of XYZ to sub DEF, and the stock had a "tax basis"

of 500 million, but its value had declined to only 100

million, the 500 million tax basis was added to ABC's

basis in its DEF sub, and the XYZ stock "carried over"

its 500 million basis in the hands of DEF. Now in W$R,

as under the US tax law, when the tax basis of the stock

that is contributed is higher than its value, the basis

of the XYZ stock will no longer be 500 million. Its tax

basis will be set at its market value of 100 million.

This also applies to capital contributions of bonds.

(Clang! The sound of two more loopholes closing!)

- When a bank you control is selling off a corporate loan,

such as where the debtor has a "D" credit rating, the

sim will look for another bank that has enough cash to

purchase the loan. In prior versions, if you controlled

any other banks, the program would first look for any

other bank you controlled and ask if you want it to be

the buyer; if it could find no such controlled bank, or

if it did and you answered "no" to the question for each

of your other controlled banks, the loan was then sold

to the first uncontrolled bank it randomly found that

had sufficient funds to make the purchase.

However, if, for example, you controlled 20 other banks

that had ample funds, W$R previously would go through the

list and for each such bank it would ask if you wanted

to sell the loan to it. Obviously, if you were dumping a

"D"-rated loan, you wouldn't want to sell it to another

of your banks, so that could be annoying. In this

version, the software simply randomly looks for a bank

you do not control (which has adequate funds) and instantly

has it buy the loan you are trying to sell.

- Version 9.50 is file-compatible with saved games from

Versions 6.0 or higher.

- 9.01 to 9.06 -- Released January 8 to March 21, 2021 (Minor upgrades and bug-fixes)

- Added a question after a cash flow warning, which asks if you

want to make the company for which the cash flow warning was

issued the "Active Entity," in case you quickly want to have

it take actions to deal with the problem, or if you just want

to look at its financials, without having to look up its stock

symbol and enter it.

- Changed rule on dividends received deductions for corporations,

so that now the 50% dividends received deduction is allowed on

dividends a corporation receives from an Exchange-Traded Fund

(ETF).

- Fixed bug that was prohibiting a company with less than a "BBB"

credit rating from selling covered call options against stock

it owns. The general rule in W$R is that a company must have at

least a BBB credit rating to initiate a sale of a "naked" call

option, but that rule should not have applied to selling a call

against stock the company owns, even if the seller has a "D"

credit rating, since it can always deliver the stock if the call

option is exercised against it.

Added estimated quarterly storage fees of physical commodities

to the cash flow projection, an item which was inadvertently

left out of the Version 9.0 cash flow projection calculations

for corporations.

- Fixed an error that could occur when an insurance company tried

to sell subprime mortgages at a loss.

- Expanded the table in Who's Ahead listing to allow full 20-character

player names.

- Version 9.06 is a free upgrade for customers who bought any of

the registered versions 9.0 to 9.05. Email us for a link.

- 9.0 -- Released January 1, 2021 (Major upgrade)

- We have received a number of requests from users in the last

year to include some kind of cash flow projection or warning

system when companies you control are about to run out of cash.

Our response has generally been, "Nice thought, but devilishly

difficult to see how I could do that, especially where there are

complex corporate structures involving complexities like the

presence of convertible bonds or 80%-owned subsidiaries that

are contributing unknown amounts of taxable income and/or tax

credits to a consolidated group's tax calculations, all at

different times."

Nevertheless, during our period of house arrest ("self-quarantine")

during the COVID-19 crisis, we have had plenty of time on our hands,

which we didn't want to waste watching the rubbish on the telly, so

we decided to tackle that thorny project, knowing that it would be

vastly more complex than the existing cash flow annual projection for

the individual players. It was, but we've come up with a cash flow

projection for non-bank corporations that isn't perfect, but will

generally give you a pretty good estimate of the near-term cash flow

of a corporation, with considerable detail, giving you some ideas

of what policies you need to quickly change if your corporation is

burning through its cash and credit rapidly and headed for a crack-up

on the financial rocks. Accordingly...

This version now includes detailed 3-month cash flow projections

for corporations, which can also help you determine when a stock

you are considering an investment in (or shorting) is about to run

out of cash and/or borrowing power, and perhaps be forced to sell

off assets when it has burned through all its cash and credit. Or,

it can give you some assurance that a company is sailing along

smoothly, with no near-term liquidity problems. The complex code

that does the calculations is also a diagnostic tool that can

give you warnings (pop-ups or in research reports on a stock)

when a company is about to experience a serious cash crunch in

the next three months. In such cases, the actual projection and

how it is being calculated will also show you where the worst

bleeding is occurring, so you can take appropriate action -- if

possible.

This feature is also an invaluable tool, once you recognize that

your company has a cash flow crisis coming. You can do "what-if"

analyses of changes like cutting the dividend paid, slashing R

& D spending, or cutting back on the growth rate, or increasing

the dividends paid by stocks your company owns controlling

interests in, and doing new cash flow projections to see how

such changes in policy will affect the bottom line cash flow, to

prevent your company from having to make forced sales of assets.

In addition, if you change certain settings that directly affect

cash flow (dividend payout, asset growth rate, or productivity

spending), you will be given an immediate warning if an increase

you make in one of those settings will trigger a major cash flow

problem in the next 3 months, in which case you may want to reverse

the change you have just made.

- Another new feature in this version is the addition of

another 5 exchange-traded funds (ETFs) to the 15 sector ETFs

that were added in Version 6.30 (in 2012). These new funds

consist of three bond funds, and two triple leverage (3x)

index funds. One bond fund invests only in government

bonds, another invests only in investment-grade bonds

rated BBB or better, and the third fund invests only in

junk (high yield or convertible) bonds with ratings of

BB or lower, if available, (but not "C" or "D" unless the

issuer is profitable and appears likely to improve its

credit rating). The bond funds have somewhat volatile share

prices, fluctuating mainly in reaction to changing interest

rates, but can be a good place for industrial companies or

holding companies to invest excess liquid funds.

We appreciated the suggestion from a user that we build

in 3X leveraged index funds, which we thought was a great

idea! And while we were at it, we decided that adding bond

funds might also be an interesting addition to the sim.

As in the real world, the two index funds tend to be very

poor long-term investments, because of their constant

buying and selling of index futures contracts, but are

explosive vehicles for short-term trading. The long,

or "bullish" ETF attempts to track the movements of the

Global Stock Index, times 3. The other, "bearish," index

fund is designed to try to approximate 3 times the movement

of a short position in the Global Stock Index. Each index

fund initiates futures positions no further out than 8

months and seeks to maintain total futures positions that

are roughly 3 times the net asset value of the ETF. The

bullish fund can quickly be wiped out by either a "Black

Swan" market crash event, or, in the case of the bearish

fund, a massive "melt-up" in the stock market.

The best thing we can say about these two 3x leveraged

index funds is: "Buyer beware! And hang on to your hat

for a wild ride!"

These 5 new funds do computerized trading according to

complex algorithms only. Thus, a player who controls the

insurer or securities broker that is the investment advisor

to one of these 5 new ETFs will not be able to make any

investment decisions for the index funds and only limited

decisions for the bond funds, which will attempt to remain

almost fully invested in bonds at all times. However, you

can still make certain limited financial decisions, such as

possibly doing new stock or bond issuances, or calling in

existing bond issues. The corporate bond funds will quickly

sell off any bonds that no longer meet their investment

criteria, such as D-rated bonds or bonds that are much

higher- or lower-rated than the credit category of bonds

the fund is limited to holding.

Because your management functions for these new funds will

be very limited, your company that is the advisor to such a

fund will not be eligible to earn hedge fund-like performance

bonuses, or management fees in excess of the 0.2% of assets

minimum, unlike what they may earn for superior performance

of the 15 (older) equity ETFs. The new ETFs are pretty much

on "cruise control," with algorithms doing the trading so

that they maintain their character.

- A new "pandemic" crisis scenario has been added in this release.

It will only occur very rarely, but, as in the current real world

COVID-19 pandemic, when it does, the effects will be devastating

(unless you happen to own gold or shares in the new triple-leveraged

inverse index fund ETF, described above)! Like the "Peak Oil" and

"Subprime" crises that can some times occur in the simulation, the

new Pandemic crisis scenario can drag on for years, crushing stock

prices and causing numerous bond defaults and bankruptcies, a time

of much fear & loathing for bulls -- or great fun, if you are a

bear (short seller).

- Prices of put or call options on the stock of the two 3X

leveraged index funds have been significantly increased

in the options pricing algorithm, recognizing the extreme

volatility of those two ETFs. Conversely, prices for

options on bond ETFs, which ordinarily experience very low

volatility, have been reduced in the pricing algorithm.

- Restrictions have been imposed on the debt leverage that

an ETF may take on. An ETF in W$R must now maintain a net

asset value that is at least 3 times the amount of its debts

(bank loan and/or bonds issued). If its net asset value falls

below that requirement it will be required to pay down bank

loans, possibly forcing a sale of some of its investments.

This means that an ETF's line of credit will be smaller

than a corporation with the same credit rating, and that

when an ETF issues bonds, the amount will be limited

by the foregoing "300% Rule," which is based on a U.S.

law (the Investment Company Act of 1940) that similarly

regulates investment companies, such as ETFs.

- Another change has been made to make ETFs more realistic.

Capital gains dividends are now only paid at the end of

the year, rather than quarterly, as is true of real-world

investment funds. Previously, an ETF might distribute

large capital gains in the first quarter or two, but then

have capital losses in the following quarters, perhaps

with little or no net gains for the year, but its assets

will have shrunken due to the quarterly capital gain

distribution. This change allows for a netting out of

gains and losses during the year, which will help to

prevent or slow the steady shrinkage of ETFs' assets

over the course of a game.

- At another user's suggestion, a new item has been added to

the Database Search function, which allows you to narrow

your search to a single industry. For example, you might do

a search of all banks rated as a "STRONG BUY" by analysts

and which have an increase of 10% or more in projected

quarterly earnings for the next quarterly earnings report.

Another improvement to the DataBase Search routine, for

bond searches, now sorts the display of the bonds that meet

your search criteria by the maturity date of the bonds.

This will make it easier, for example, to find bonds that

mature very soon, which can be a good place to park excess

cash at a reasonable interest rate. However, if you check

the "Credit Rating" button to only display bonds with a

specified minimum credit rating, then the bonds will be

sorted by credit rating, as in prior versions of the game.

- Loan amortization has been added for "mass loans" made by

banks and insurance companies -- the quarterly principal

payments of cash to the bank or insurer are equal to

5% of consumer loans, 2% of prime mortgage loans, and

1% of subprime mortgage securities owned by the institution,

but flow in monthly at 1/3 of the quarterly total amounts.

Of course, banks that have the asset allocation formula

turned on will soon reinvest the cash according to that

formula.

The varying amortization rates for corporate or ETF loans,

which depend on multiple factors such as creditworthiness

and cash balances of the borrower, have not changed. As

before, "margin loans" to players are not amortized, and

repayment is only required when the player receives a

margin call because of insufficient collateral, due to a

drop in the player's net worth.

- Bank financing (lines of credit) lending rules have been

liberalized considerably. Companies may now borrow amounts

ranging from 1.5 to 3 times net worth, depending on the

Difficulty Level at which you are playing and certain

economic conditions. Thus, in the spirit of the times,

Wall Street Raider companies will be more leveraged in

the new version, especially if you play at the higher

difficulty levels 3 or 4.

- A number of improvements have been made in the anti-trust

litigation features. The main change is that the amount of

legal fees incurred by both the plaintiff and defendant are

now sharply reduced, by roughly half, if a case settles

after pre-trial discovery has concluded, instead of going

to trial. (Sort of an inducement to stay out of costly

court trials.) Also, when a company you control is being

sued and you are asked to accept or reject the settlement

offer, you are now shown the amount your company has already

incurred as legal fees, and the estimated total fees it will

incur if you choose to go to trial, and similar information

is shown when your company is the one suing, and you are

asked to enter the amount you would be willing to settle the

case for, on the courthouse steps.

- Since Internet Explorer is getting long in the tooth, and

Microsoft says they won't be supporting it much longer, we

have modified portions of the W$R software that previously

used Internet Explorer to access the Internet or to view

certain files, such as the W$R Strategy Manual. Thus, now

the program will use whatever browser (Chrome, Firefox,

Edge, Internet Explorer, etc.) that you have chosen as

the default browser that you use on your computer.

- When we are planning to buy a stock for Alpha Corp, which we

control, we will often select 2 or more companies we do not

control as Active Entity, researching each of them, such as

DEF Co. and XYZ Company. Then, once we decide to buy some

stock of DEF Co., we may want to take another look at Alpha's

financial profile before doing the transaction. Until now,

this usually meant entering Alpha's stock symbol before we

take one last look at its financials and buy the DEF stock.

We've often found that to be slow and a bit time-consuming,

especially if we have forgotten Alpha's stock symbol.

In this release, we have replaced the "Line of Credit" item

on the main screen (in the "Active Entity Selected" box)

with an "Acting Now" item, which will show Alpha's stock

symbol or name as the controlled entity that is doing the

transaction if, for instance, we click on the "BUY STOCK"

button. Now we can simply click on that item and -- presto!

-- Alpha is now the Active Entity and we can take a quick

look at its statistics, without having to remember or

look up its stock symbol and enter it again. Just a small

labor-saving tweak we felt most users will like, since the

line of credit information is available in various other

places, like the "Credit Info" button or in a company's

Financial Profile.

- We have made a number of refinements to the "taxable

liquidation" feature. The main change was to close a

loophole that could allow a player to weasel out of the

ugly situation where his or her company is subject to

ongoing asbestos or "SuperFund" environmental clean-up

lawsuits or costs, by quickly doing a taxable liquidation

before the company's assets are too severely depleted.

Now the liquidating company will have to set aside 5% of

its total assets or a minimum of U.S. $200 million for

asbestos claims or $100 million for environmental clean-up

costs) before it can liquidate. (No set-aside is required

in a TAX-FREE liquidation, since the parent company takes

on the liquidated subsidiary's liabilities, including its

liability for the asbestos or environmental damages.)

- When you start to purchase stock in an ETF, you are given

a warning that if you and/or your companies acquire more

than 15% of the ETF, it will be disqualified and lose its

tax-exempt status as an investment company. In this version,

the warning will also tell you what percent of the ETF that

you and the companies you control already own, so you don't

accidentally buy too much of the stock and cause the fund

to be disqualified.

- We fixed a minor bug which could occur in games involving

multiple human players. When there is only one human player,

the stock ticker, if running, will continue to run even

after your turn ends, if W$R becomes the background program,

such as when you open another program, like your browser,

and W$R is no longer visible on your computer screen. That

is what we intended. However, that was still occurring when

there were 2 or more human players, which meant the ticker

could keep running after your turn ended, when it should

have stopped and waited for the next (human) player to begin

his or her turn, which it now does since we have fixed the

problem. Thus, now, if there are 2 or more human players

and you cover the W$R screen with another application while

the ticker is running, it will only run, at most, until

your turn has ended, at the end or midpoint of a calendar

quarter.

- Version 9.0 is file-compatible with saved games from

Versions 6.0 or higher. Although the 5 new bond and index

fund ETFs were not created in a game you may have started

and saved with v. 8.72 or earlier versions, the 5 new ETFs

will automatically be created and inserted into a game you

saved with a prior version, when you load the old saved

game file.

- 8.72 -- Released March 15, 2020 (Minor upgrade from 8.70/8.71 and bug fix)

- Improved the bank loan purchases feature, used when your bank is

buying business loans from other banks. Previously, if you were

doing several such purchases, your bank had to use only its

existing cash balances to make the loan purchases. Now, it can

continue buying if it has T-bills and receives deposits of cash

from its new loan customers, as soon as it becomes their banker.

- We have noticed in Versions 8.70 and 8.71 that a bank occasionally

will go bankrupt at a time when all banks should be thriving, for

no apparent reason, or that sometimes a bank we owned and were

watching closely would sudden have more (or less) cash than it

should, for no good reason. It only happened on rare occasions

but we suspected it was an obscure bug in the banking segments

of our code, but we were not sure if was actually a bug, since

we knew it could have been one of those random nasty events like

"rogue employee embezzles $10 billion from XYZ Bank."

However, a user of 8.71 reported that a bank he owned and was

closely watching sudden got a large unexpected infusion of cash,

with no effect on earnings, which gave us a clue of what to look

for in the 115,000 lines of WSR code, most of which is convoluted

logic, not GUI.

Finally, after over a month of testing and doing diagnostics,

we were at last able to generate the glitch a few times

and noticed what appeared to be a pattern -- the dates in a

calendar quarter when the loans to a non-existing bank would

sometimes randomly occur. We followed a long trail of bread

crumbs, and finally found the error -- in a part of the code

that deals with antitrust lawsuits, rather than banks, in those

rare cases where a plaintiff with little or no cash or line

of credit gets a quick emergency bank loan to pursue a lawsuit,

in exchange for allowing the bank to earn an additional loan

fee equal to 10% of the amount borrowed, if the plaintiff wins,

when it is a "slam-dunk" case. So, in short (Hallelujah!), we

have FINALLY found this rare and elusive bug and fixed it,

after a month of burning the midnight oil, though it is one bug

you may never have noticed since you downloaded 8.70 or 8.71.

Version 8.72 is a free upgrade for anyone who bought

Version 8.70 or 8.71. Contact us at the email link at

the bottom of this page for a download link for v. 8.72.

- Version 8.72 is file-compatible with saved games

from Versions 6.0 or higher.

- 8.71 -- Released January 12, 2020 (Minor upgrade and bug fix)

- Fixed minor text error -- Incorrect text was displayed when

attempting to sell stock of a company that is not publicly

traded, erroneously stating that the seller owned 100% of

the stock, even if he/she/it did not, although play was

not affected. In short, good code, bad text message.

Version 8.71 is a free upgrade for anyone who bought

Version 8.70. Contact us at the email link at the

bottom of this page for a download link for v. 8.71.

- We made it less automatic, when you list a stock as

"For Sale," to find a buyer, when the value of the

company being offered (using the "Offer to Sell Stock"

button on the MISC Menu) is too high, though sales of

stock in small companies are not affected, other than

the fact that it may now take a while longer before

a buyer comes along and takes the offer. In previous

versions, such stock offers were usually snapped up

almost instantly, if there were any buyers that were

sufficiently liquid. We simply made this feature

more realistic; the greater the cost of a block of

stock that is offered, the less likely a buyer can

be found.

- When you conrol insurers or securities brokers that

manage one or more ETFs, the quarterly reports for

those ETFs will pop up, like companies you control,

unless you have turned on the "Suppress Earnings

Reports" setting. Also, when you click on the "FILL"

button on the main screen, to fill the Streaming

Stock Quotes list with stocks you own, have short

positions in, or that you control, or stocks on

which you have other equity positions in (options

or convertible bonds), this version will also add

to the list any ETFs that are managed by companies

that you control (if there is room on the list).

- Version 8.71 is file-compatible with saved games

from Versions 6.0 or higher.

- 8.70 -- Released January 1, 2020 (Major upgrade)

- In response to user suggestions, we have made some

major revisions regarding the 15 Exchange-Traded Funds

("ETFs") in the Wall Street Raider simulation. Users

have been asking for a way to manage the investments of

ETFs and, somewhat like hedge funds, the opportunity to

earn large performance bonuses for superior results. As

long-time players of W$R are aware, it has always been a

rule that you need to buy 20% or more of a company's stock

in order to control it, and if you bought over 15% of an

ETF, it would no longer qualify as a tax-exempt investment

company. While each ETF was nominally "managed" by an

investment advisor (an insurance company or securities

broker), all that meant was that the "advisor" received

quarterly management fees, as a percentage (0.2% to 1.0%

annual rate) of total assets of the ETF, but didn't

actually direct the ETF's investment activities, which

are all managed by the software.

Accordingly, we have made a number of significant changes

to enable players to actually manage most of an ETF's

financial affairs, if the player controls the company

that is the investment advisor/manager of the ETF. The

changes include the following:

- On the Buy/Sell, Financing, and Misc Menus, if

an ETF managed by a company that the player controls

is selected as the Active Entity (or was the most

recently selected previous Active Entity), the ETF can

engage in several actions on each of those menus: buying

and selling stocks and options, doing public stock

offerings (only once a year, in December, and only

if the ETF's shares are up 15% or more for that year),

bond issuances, calling or buying back bonds, and

borrowing or making repayments of bank loans. Note

that issuance of new stock will bring more net assets

under the advisor's management (resulting in higher

advisory fees).

- As before, the company that is the advisor to an

ETF will receive a "base fee" paid quarterly, based

on the ETF's total assets, at an annual rate of 0.2%

to 1% of total assets. However, if the base fee is

set at the minimum 0.2% rate, the advisor MAY also

earn a performance bonus for each 2-year measurement

period, if the ETF's net worth (as adjusted for

capital gains dividends) has grown by more than 20%.

In general, this "gain-sharing" performance bonus

will be similar to what hedge funds usually take: In

this case, 20% of any gain in excess of 20%. Thus,

if net worth per share increased by 50%, the excess

would be 30%, and the advisor's bonus would be 20%

of that, or 6% of the beginning net assets, which

can be a very large number, giving a HUGE boost to

the earnings of the insurance company or securities

broker that is the advisor.

- To facilitate players' ability to have a controlled

company become the advisor to an ETF, the Management

Menu now will contain a "Become ETF Advisor" menu item

for an insurance company or securities broker that you

control. If you click on it, your company will be able

to buy the contractual rights to manage an ETF you

choose, by paying the existing advisor an amount equal

to 10 times the annual base management fee then in

effect. (This button only appears if your company does

not already manage any ETFs.)

- Once your company becomes an ETF's investment

manager, you can begin trading stocks and options

for the ETF, and possibly raising more funds by

issuing more ETF stock or a bond issue. You may also

want to lower the annual fee to 0.2%, to become

eligible for possible performance bonuses, as noted

above, or you may just want to raise the annual fee,

although that is now only allowed if the ETF stock

has outperformed the Global Stock Index by at least

2% in the last 12 months. To be eligible for a

performance bonus fee, the base rate must be set at

0.2% for the entire 2-year measurement period. (For

some ETFs, the measurement period ends on December 31

of an odd-numbered year; for others it ends on the

31st of December in an even-numbered year.)

- If you are managing an ETF, you can also have it

buy back bonds it has issued or pay an extraordinary

dividend of up to 30% of the total of its cash and

T-bills, as long as it does not owe any bank debt or

bond indebtedness. However, you probably will not want

to have it pay any extraordinary dividends, since that

would reduce the amount of assets upon which the

advisory fees are paid.

- As in prior versions of W$R, there are limits

on how much an ETF can invest in one stock --

which is 10% of the company, and it can only have

one put option contract (on up to 10% of a stock),

and one call option contract on a given stock at

any one time. Each ETF can only invest in stocks

or options of companies in a certain sector, such

as energy or health care. In addition, as in prior

versions, if a particular stock becomes too large

a part of an ETF's portfolio, it may be forced to

sell part of that stock holding, so you can't put

all of an ETF's eggs in one basket!

Also, only one ETF is allowed to speculate in

commodities, and you don't manage that activity --

the commodity trades are deemed to be done by a

commodities broker and all such trading will

cease once your company becomes the active advisor

to that ETF. The same applies to the one ETF that

is randomly chosen each game to occasionally

engage in interest rate swaps. So you won't be

able to take extreme gambles with the assets of

an ETF you manage.

- If you grow weary of actively managing an ETF,

you can just put the company that is advisor to

the ETF on "AutoPilot," and the software will take

over management of the ETF at that point, as it

does for other ETFs that players do not have the

right to manage. If you are actively managing one

or more ETFs, you will periodically get a pop-up

reminder, if you have not done any transactions on

behalf of an ETF in the past calendar year.

- In prior versions, the prior stock price history

of an ETF was adjusted downward each time the ETF

paid a capital gains dividend or an "extraordinary

dividend" (a non-taxable return of capital), so that

such distributions would not reduce the ETF's total

return to shareholders, on which certain incentive

fees to the manager were based. Starting with this

version, we have decided to also reduce the previous

stock price history records by "regular" (taxable)

dividends, in order to give a true picture of the

ETF's total return on investment for shareholders,

which should and now does include share appreciation

PLUS all cash distributions.

- A new setting has been added as an item on the Game

Options Menu: "Max Growth Rate (Global) Throttle."

This works like a throttle, to set a speed limit, such

as 15% (or even a negative percentage), on the rate

of growth of all the industrial companies you control

that are operating on "AutoPilot." This feature will

mainly be useful when you have a large number of

controlled companies on AutoPilot and do not want

them to grow their business assets at more than an

annual percentage rate you specify, from -10% to 60%.

The default rate, unless you change it, is 60%, but

having the "throttle" set at a high growth rate like

50% or 60% does not mean that your companies will all

begin trying to grow their business assets at that rate.

It simply sets a maximum rate of growth, one that the

AutoPilot function will not allow your companies to

exceed. Within that limit, AutoPilot will function

as it did before, having some companies grow assets

faster or slower, or have some actually reduce their

business assets, by as much as 10% a year. But none

will exceed the "speed limit" growth rate you set

by changing the "throttle" number setting.

The throttle feature will be particularly handy at

times when there is a sudden change in the economy,

such as a depression, when you have a large number

of controlled companies on AutoPilot, at which time

you could simply change the throttle setting to a

minus rate, like -10%, to quickly have all your

companies start DISinvesting in assets that are

likely to become unprofitable. In the past, you had

to change the growth rate for all your companies,

one at a time, using the SET GROWTH RATE button on

the Management Menu, and the AutoPilot function

could in many cases quickly reverse your changes,

unless you turned off AutoPilot for each such

company.

Keeping your companies from trying to grow too fast

has other benefits, such as preventing them from

getting too large a market share, which would make

them targets for antitrust lawsuits; or preventing

them from creating oversupply vs. demand in their

industry; or from pouring too much money into assets

that are earning a low (or negative) rate of return,

which could hurt the company's earnings and/or its

credit rating.

Note that the limit on growth rate set by use of

the "throttle" setting does not apply to companies

that you actively manage (i.e., those that are

not on AutoPilot) and does not apply to financial

companies -- banks, insurance companies or to

holding/trading companies.

- In prior versions, the "Buy" or "Strong Buy," and

"Sell" or "Strong Sell" recommendation buttons at

the bottom of Research Reports could be clicked on

to immediately buy or sell the stock in question.

However, those buttons were not always very helpful,

in certain situations. We have made some major

modifications to those functions, to very quickly

identify entities you control that might be sellers

of that stock if you click on the "Sell" button on

the research report for that stock.

Also, in prior versions of W$R, when a company you

controlled was the Active Entity and you clicked on

such a "Buy" button to buy that stock, you would

get an error message that the company cannot buy

itself or sell its own stock short. (An LBO or

Greenmail buyback is required, for a company in

W$R to buy its own stock, and a stock offering

is required for a company to sell its stock.) Now,

if you click on the "Buy" button on a Research

Report on the current Active Entity, the software

will suggest an entity you control (or you,

personally) as the buyer.

- Players who have gotten in a weakened financial

condition have probably encountered the aggressive

action whereby one of the computer players does a

hostile merger, merging a company with massive,

ongoing asbestos litigation liability or "Superfund"

environmental cleanup costs with a company of yours,

doing major damage to your financial empire. We

think it is a neat feature, but not when it occurs

repetively in one game, so we have made changes to

prevent such multiple occurrences of this nasty

tactic over a short period of time, like 5 years.

- A new "ethical scenario" has been added, for firms

in the security industry, involving the sale of its

clients' passcodes and and other security secrets

to criminals.

- Version 8.70 is file-compatible with saved games

from Versions 6.0 or higher. As in all upgrades,

the "Help" files and optional Strategy Manual have

been fully updated to reflect all significant

changes in the simulation.

- 8.57 -- Released May 1, 2019 (Minor upgrade)

- A new item has been added to the Settings pull-down

menu. It allows you to clear the stock price history

of the currently selected Active Entity. You may have

noticed that if, for example, you add $10,000,000 M.

as a capital contribution to a small company that

previous had only $50 million of assets, that will

greatly increase its stock price, and the prior

stock history on the stock chart for the previous

5 years will look like an almost flat line, which

isn't particularly useful, going forward. This new

menu item lets you zero out the previous stock

history, and start a new stock history, to make the

information the company's stock chart provides much

more useful.

If you, as Player, are the current Active Entity, this

feature will zero out your prior net worth history

that appears on the chart of your net worth changes.

- Version 8.57 is file-compatible with saved games

from Versions 6.0 or higher. It is a free upgrade,

on request, for anyone who bought Versions 8.50 or

8.55 (which had serious bugs) or Version 8.56.

- 8.56 -- Released April 1, 2019 (Minor upgrade and bug-fix from 8.55)

- This is a free upgrade for anyone who has registered

Versions 8.50 or 8.55, as we fixed bugs that several

users reported in those two versions.

If you are a registered owner of Versions 8.50 or 8.55,

email the author (link at bottom of page) for a FREE

download link for Version 8.56.

- Some crafty players have found a way to (temporarily)

get around the W$R restriction on circular chains of

stock ownership, and by inflating the value of one of

the companies' shares, caused the stock prices of all

the companies in the circle to shoot upwards to near-

infinite prices, before W$R stepped in and broke up

the circle, by forcing a divestment. Version 8.56

does much more frequent searches for such circular

stock ownership, to nip such schemes in the bud, and

is now more sophisticated in stopping attempts to

create such circles, before the "virtuous circle" of

rising stock prices in the companies can get started.

Even cross-ownership of more than 10% of parent by

its sub, for example, will now be blocked or quickly

undone by a forced divestment.

- In the "My Corporations" listing of all the companies

you control, we have added another column of useful

information, showing the percent of revenues each such

company is spending or R&D or marketing. This will be

very handy if one of your companies is spending a lot

on R&D or marketing, resulting in losses, and is also

expanding rapidly, which would widen such losses. Now

you can notice any such unprofitable or unwise combination

of settings for any of your companies at a quick glance.

- The bond portfolio listings of corporate convertible bonds

owned by players or corporations now indicate, with the

abbreviation "cv." before the coupon rate, that the bonds

are convertibles. As such, you can now tell at a glance

which bonds in a bond portfolio have equity features.

- An accounting change was made in this version, for

companies that own less than 20% of the stock of another

company. Previously, if the two companies were under

common control, and XCorp owned 12% of YCorp, XCorp

would include 12% of YCorp's reported earnings in

XCorp's earnings, using the "equity method" of

accounting for income from a subsidiary, and the

dividends received from YCorp were not included in

reported income. We decided to change that method,

so that now XCorp must own at least 20% of YCorp to

include a percentage of YCorp's earnings in XCorp's

earnings (regardless of whether the two companies

are under control of the same entity).

- 8.55 -- Released: February 5, 2019 (Relatively minor upgrade from 8.50)

- We have refined the Database Search feature added in 8.50,

which allows you to exclude all but industrial companies

from searches, by excluding financial companies -- banks,

insurers, holding companies, and ETFs. That feature also

excludes companies you already control.

Since some industrial companies have only a small amount

of operating assets ("business assets"), in relation to

their other assets, such as stocks, options, cash, and

T-bills, they are much like holding companies, since

their operating assets may have only a minor effect on

their total earnings. Thus, we have tweaked the feature

that lets you choose to exclude financial companies and

companies you control to also exclude from search results

any industrial company whose "business assets" are less

than 20% of its total assets.

- Some players have suggested that they should be able to

turn off the bank automatic allocation of assets for

any bank you control. A good idea, so we have added an

"OFF" button on the Asset Allocation menu screen in

this release.

- After releasing 8.50, we had second thoughts on the

choice we made to have companies that you actively

manage not automatically buy or sell T-bills. Other

companies, not controlled by players or controlled but

on AutoPilot setting, automatically buy T-bills if

the percentage of their total Cash + T-bills consists

of less than 60% T-bills, or sell some T-bills if

htat percentage is over 80%. That left all decisions

on how much of companies' cash to invest in T-bills

strictly up to the player for actively managed companies.

We have made a minor change, so that now an actively

managed company that has cash will automatically buy

some T-bills if its percentage of T-bills falls below

60% -- but it will NOT automatically sell any T-bills,

except to cover any cash deficit that arises. Thus,

for an actively managed company, you can put all of

its cash into T-bills, and the T-bills will not be

sold unless necessary. (However, cash that comes in,

such as from earnings, dividends or other sources,

will gradually build up until it is more than 40%

of the total of Cash + T-bills, at which point an

automatic purchase of T-bills, up to about 80-90%,

will occur.)

- A major accounting change has been made for the way

bond holdings are valued, for banks and insurance

companies. Previously, bonds that those entities held

were valued (in computing net worth) at their current

market value, which resulted in wide swings in net

worth when interest rates went to extremely high or

low levels, sometimes resulting in negative net worth

for banks or insurers, even though they generally

would hold most of the bonds until they matured at

face value. At a minimum, such fluctuations in bond

values based on interest rates caused regular changes

in the entities' credit ratings and violent swings

in their stock prices, due to the changes in net worth.

This was particularly true for banks, with their

enormous leverage.

Under the revised system, bonds held by banks or

insurance companies are now valued at their cost,

plus or minus any discount or premium amortization

that has occurred since purchase, which means they

are valued at their "tax basis." The only exception

is for D-rated bonds, which are still valued at the

LOWER of their market value or their adjusted cost

(i.e., tax basis).

- In another modest accounting change, government and

corporate bonds are no longer traded "flat" (without

accrued interest). Now, when bonds are bought, you

must also pay for the accrued interest through the

date of purchase and the seller receives that payment.

However, D-rated bonds (which are in default on

interest payments) are still traded "flat" (with no

accrued interest paid by the buyer or received by

the seller).

- A minor change was made to bond interest payments on

D-rated junk bonds. In most cases, no cash interest

will be paid on such bonds -- interest is just added to

the principal owed. However, in some rare cases, where

the bond issuer is not a bank or insurance company, owes

no bank loans, and has enough cash and T-bills for the

quarterly bond interest payment, it may pay the interest

in cash, if its financial situation is not too dire.

- The Spin-Off function, which was a bit opaque, has

been greatly refined to give players more information

about the tax effects of a proposed spin-off in a

number of different situations, in which the tax

treatment varies for different types of entities and

depending on corporate ownership percentages of the

company doing the spin-off. The rules still parallel

the U.S. tax laws on spin-offs, but the tax results,

when a spin-off is not entirely tax-free, are now

more transparent to the player, enabling you to make

much more educated decisions on whether to execute

a spin-off transaction.

- 8.50 -- Released: January 1, 2019 (Major Upgrade)

- Banks have become potentially more profitable in Wall

Street Raider -- see below, regarding player and

company bank deposits, which are now non-interest-

bearing demand deposits, rather than interest-bearing

time deposits (CDs). On the other hand, regulation of

banks has gotten somewhat stiffer, at least for banks

with too high a loan-to-deposit ratio. (Google the term

"loan to deposit ratio" if you want a bit of background

on how that figures into real-world bank regulation.)

If a bank's loan portfolio in relation to deposits and

its reserves-to-deposits ratio become too risky, the

regulators may temporarily stop a bank from lending

or buying loans, and perhaps put a freeze on lines

of credit to most corprate borrowers, as well.

When a bank is deemed to be over-extended and too

aggressive in making loans and equity investments,

the "regulators" will limit the bank's new

investments to government securities only, until

its finances are back on a sounder footing.

- As some players of W$R have suggested, in this new

version we have built in the ability to set asset

allocation percentages for banks, to help you better

manage a bank you control, even if it is on AutoPilot,

via a new menu item on the Management Menu. It lets

you set allocation percentages of the bank's assets

(for all assets EXCEPT stocks, options, and business

loans), for any bank you control. You can set the

percentages to allocate, if any, to 5 asset classes:

- Prime mortgages;

- Subprime mortgages;

- Consumer loans;

- Bonds (the total "carrying" (book) value of government

and corporate bonds, rather than current market value); and

- Cash equivalents (cash, which earns no interest, like

currency in the vault, and short-term Treasury bills,

which earn a usually low rate of interest).

- This version also allows players to set the growth rate for

"public" bank deposits, between -5% and 10%. While rapid

growth in deposits may seem best, it is a mixed blessing,

unless the growth in reserves keeps up, otherwise the

bank's credit rating will decline, meaning it will have

to pay higher interest on CDs, and if the additional

funds from new deposits are invested in loans, that

will require more addtions to the bad debt reserve,

hurting earnings -- not to mention increasing the

overhead costs of serving more deposit customers.

- A new class of investment assets has been added, and one

has been changed. In this version, players and companies

can now invest in short-term Treasury bills ("T-bills")

that are highly liquid, like cash, and do not fluctuate

in value. The rate earned on T-bills fluctuates with

overall interest rates, and is generally somewhat lower

than the interest rate on short-term government bonds,

but they are an extremely safe investment. (Safer than

bank deposits, since banks can and do fail in W$R.)

In all previous versions of W$R, all liquid assets of

players and companies (except banks) were deemed to be

held as bank Certificates of Deposit ("CDs"), on which

the bank paid you or your companies interest on their

"cash" balances. Since in the real world, corporations

generally need to maintain significant cash balances

and do not put all their liquid assets in time deposits

(CDs), we chose to make the simulation more realistic.

Now, companies' liquid assets are generally divided

(unless you actively manage the company) between "cash"

(non-interest-bearing bank demand deposits) and T-bills,

about 30% cash and 70% T-bills.

Banks still receive interest-bearing CD deposits, but

only from "the Public," along with some demand deposits

from the Public. All deposits ("cash") of players and

corporations that do business with a particular bank

are now non-interest-bearing demand deposits (which

will tend to increase banks' profitability, if they

have significant deposits from players or companies).

As in prior versions, cash assets of a bank will not

earn interest, but banks will now invest most of their

liquid, cash-equivalent assets in T-bills, like other

corporations.

- A new item has been added to the "MISC" Menu, to

allow a player or any company a player controls to

buy or sell T-bills, which is mainly useful for a

controlled company that is not on "AutoPilot," and

thus is actively managed by the player.

- The automatic "sweep" setting, when it is turned